The National Association of Realtors has stated that pending home sales for March have risen 4.1% from February and are 12.8% higher than March 2011. The last time the Real Estate Industry has seen pending sales rise at this level was April 2010 because of the Homebuyer Tax Credit.

The Pending Home Sales Index seems to be telling us that the worst of the market decline is behind us. Inventory is thinning, while (for the moment) interest rates remain super low. There are many; including Lawrence Yun, NAR chief economist, that 2012 will be a year of recovery. The nation’s first quarter closings were the highest in 5 years, and with the pending home sales, it looks like second quarter sales should be equally as good.

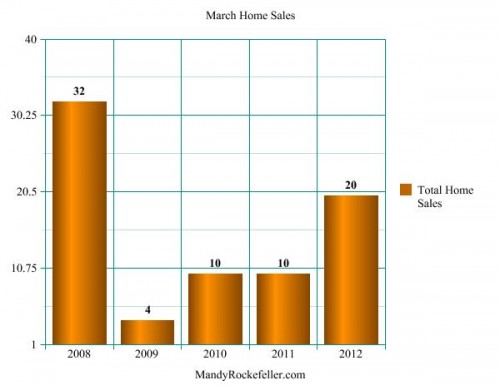

Locally, (meaning Teton Valley, ID) it appears that we’re seeing positive results as well. March 2012 is up (double, actually) in sales from March 2011. In comparison, we saw 36 home sales in March 2008 with a total sold volume of $5,485,000 and March 2012 had 20 home sales with $3,217,800 total.

* Graph only includes single family home sales in Teton County, Idaho.

* Graph only includes single family home sales in Teton County, Idaho.

What does that mean for the consumer? It means that our market is showing all signs of stabilization. With the increase of pending and sold homes, active inventory is reduced. When we have a reduction in inventory, and our demand remains the same, we’ll eventually see prices start to make incremental movement upward. Ultimately, in the short term, we’re talking a more balanced market, meeting supply and demand for both buyers and sellers.

I am an Associate Broker with Teton Valley Realty. I have been a licensed REALTOR® for twelve years and actively involved with property sales and development in Teton Valley.

I have lived in Teton Valley for over 20 years and feel fortunate to have made a home here with my husband, Travis, and two children, Conley and Arah.

I am an Associate Broker with Teton Valley Realty. I have been a licensed REALTOR® for twelve years and actively involved with property sales and development in Teton Valley.

I have lived in Teton Valley for over 20 years and feel fortunate to have made a home here with my husband, Travis, and two children, Conley and Arah.